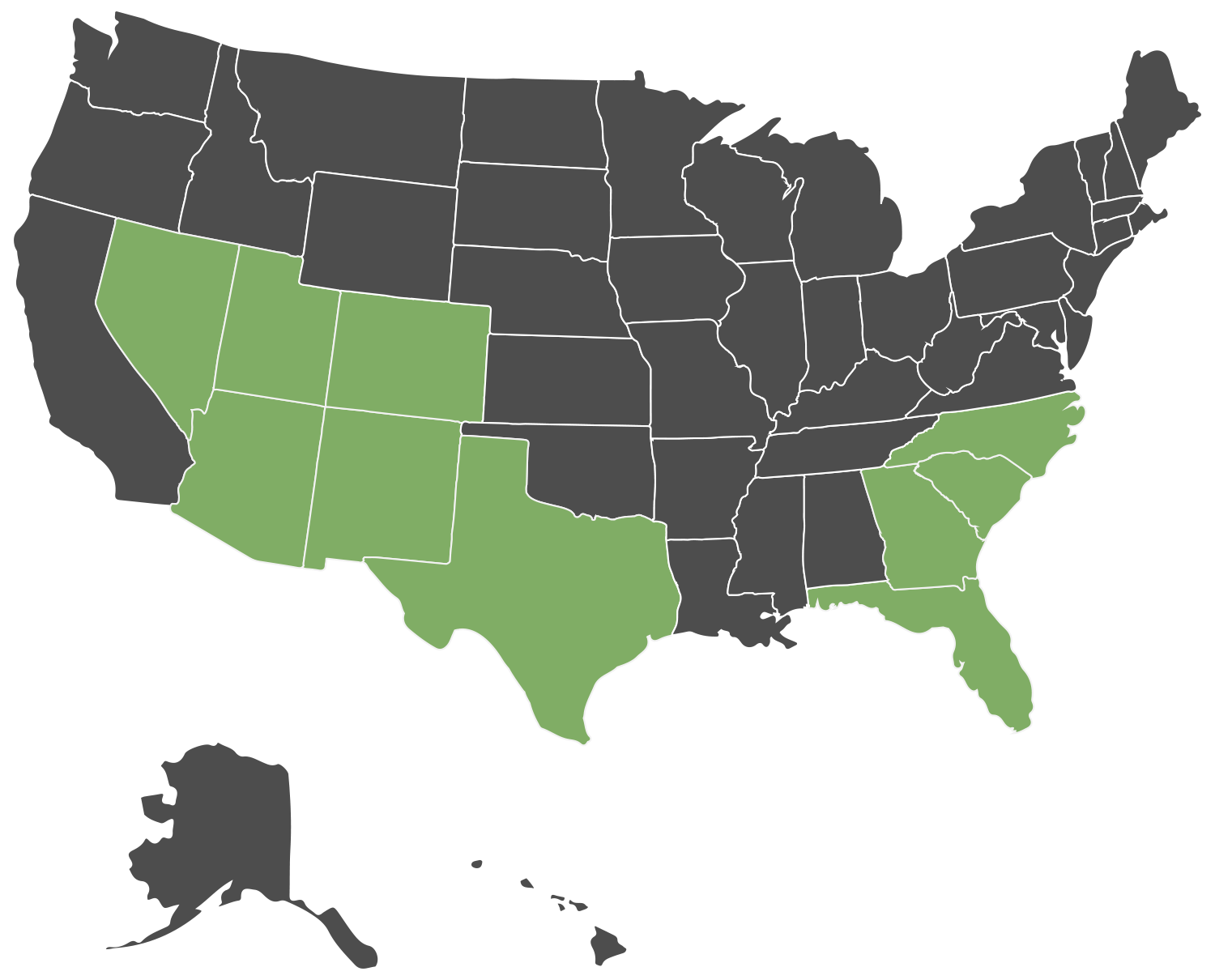

Vive Funds has identified “Stonebrook Mebane” as an opportunity ripe with strong metrics. The asset consists of 192 units located in very close proximity to the “Research Triangle” in NC (“The Stonebrook Portfolio”).

Vive Funds is extending Investors the opportunity to invest in BLV Stonebrook Investor LLC, an entity that has been created to acquire the fee simple interest of the asset.